25+ Principal 401k calculator

The annual elective deferral limit for a 401k plan in 2022 is 20500. 401k a tax-qualified defined-contribution pension account as defined in subsection 401 k of the Internal Revenue Taxation Code.

Blog Finding Financial Freedom

NerdWallets 401 k retirement calculator estimates what your 401 k.

. This calculator assumes that your return is compounded annually and your deposits are made monthly. Step 1 Gather All the Necessary Documents. A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement.

This 401k loan calculator works with the user entering their specific information related to their 401k Loan. However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to 27000. Quickly see whether youre on track with your retirement goals and see which small changes could add up to a potentially big impact.

Log in to see your. 1 IRS annual limits for 2022. Your current before-tax 401 k plan.

Start New Financials 401k calculator factors in your expected age of retirement employer matching funds your contributions and the growth of your assets and investments to estimate. The annual rate of return for your 401 k account. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Pre-tax Contribution Limits 401k 403b and 457b plans. The principal value and investment. In the following boxes youll need to enter.

To give you an idea 20000 in a 401 k 403 b or 457 b account could triple in 20 years at an average 7 rate of returnbut not if you withdraw it today. Loan terms and rates are determined by your plan administrator your employer in other words. In the US the traditional IRA Individual Retirement Account and Roth IRA are also popular forms of.

The actual rate of return is largely. TIAA Can Help You Create A Retirement Plan For Your Future. Simple 401k Calculator Terms Definitions.

Dont Wait To Get Started. Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. Compare 2022s Best Gold IRAs from Top Providers.

It is a good way to save for retirement as you cannot usually touch this money without penalty until you retire or become disabled or your dependents can gain access if you die. The interest rates on most 401 k loans is prime rate plus 1. You expect your annual before-tax rate of return on your 401 k to be 5.

First all contributions and earnings to your 401 k are tax deferred. Reviews Trusted by Over 20000000. Principal is obligated by Department of.

To calculate your Principal 401 k fees you only need 1 document. It provides you with two important advantages. For these reasons this retirement withdrawal calculator models a simple amortization of retirement assets.

Please visit our 401K Calculator for more information about 401ks. A 401 k can be one of your best tools for creating a secure retirement. Retirement Plan Fee Summary.

Your employer match is 100 up to a maximum of 4. Begin by entering your 401k loan amount the interest rate and the period of time it. It is the simplest most straightforward of all possible models by emulating.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. IRA and Roth IRA.

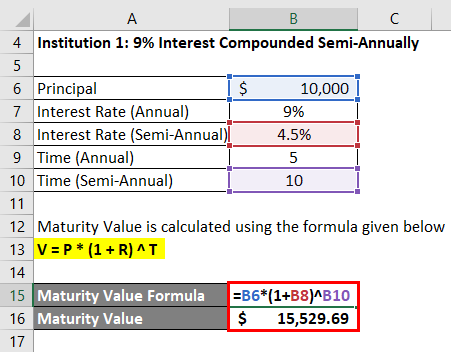

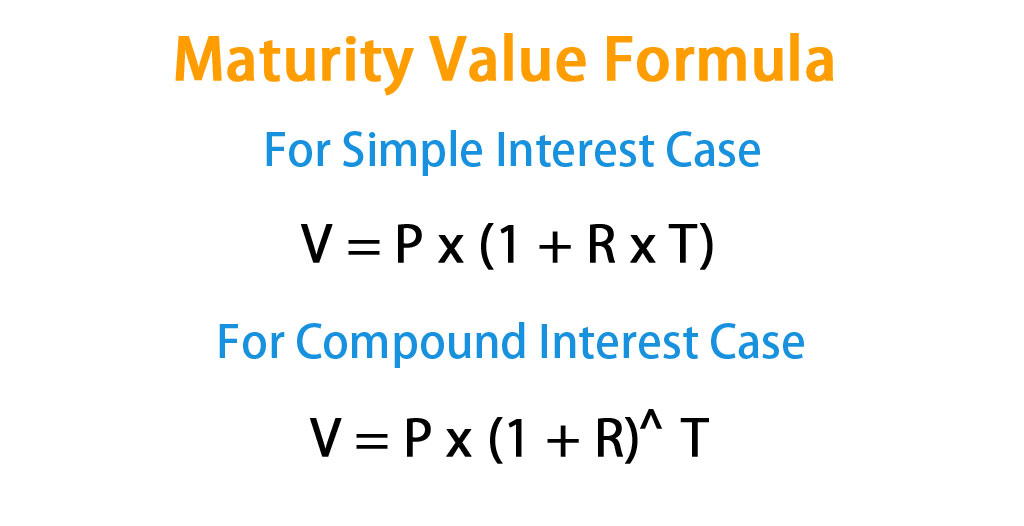

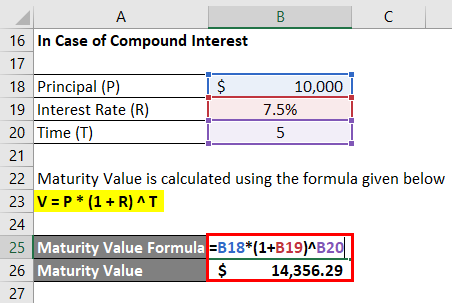

Maturity Value Formula Calculator Excel Template

Contribute To My 401k Or Invest In An After Tax Brokerage Account

Blog Finding Financial Freedom

Maturity Value Formula Calculator Excel Template

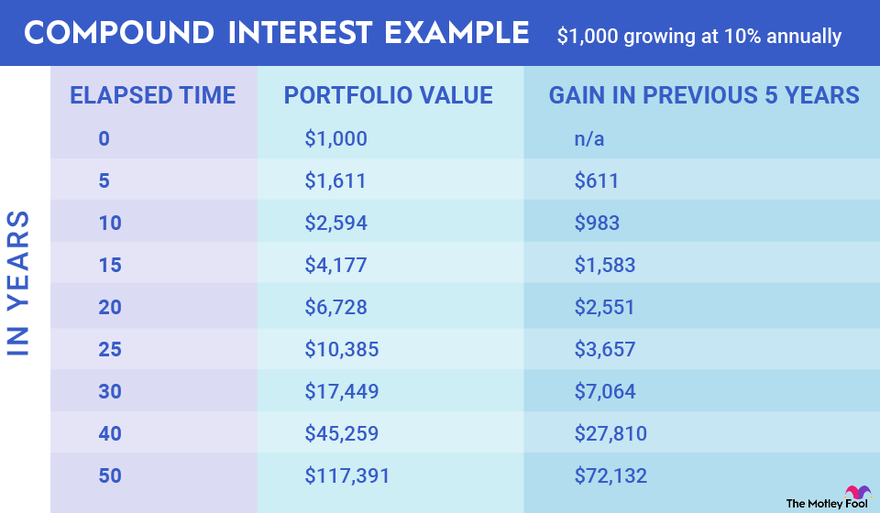

Accounts That Earn Compounding Interest

Contribute To My 401k Or Invest In An After Tax Brokerage Account

Maturity Value Formula Calculator Excel Template

Principal Paydown Think Realty A Real Estate Of Mind

Maturity Value Formula Calculator Excel Template

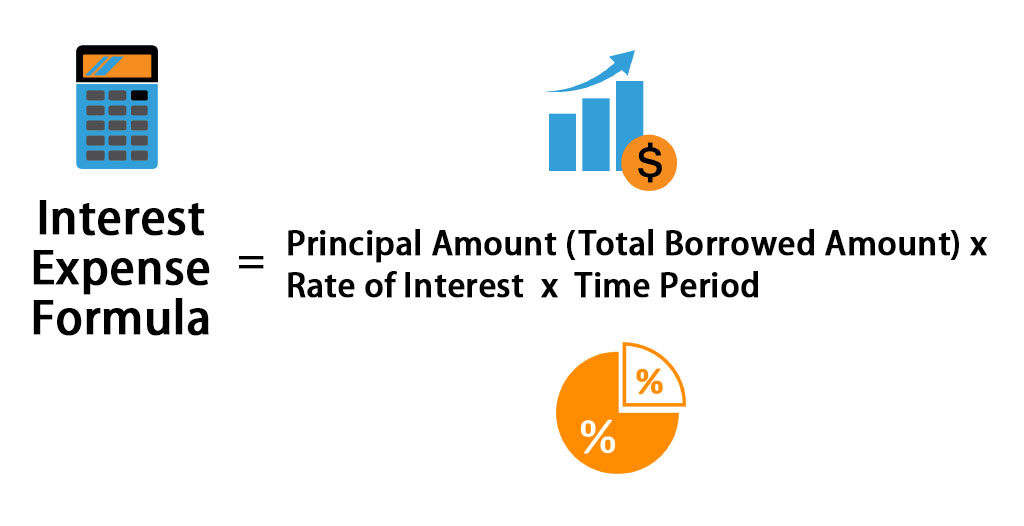

Interest Expense Formula Calculator Excel Template

Financial Planning Calculator Investment Calculator

Free Budget Worksheets Household Net Worth Spreadsheet Budgeting Worksheets Personal Budget Template Budget Calculator

Should I Own Exxon Solely For The Xom Dividend

How I Earn Over 10 Passive Income With P2p Lending

Interest Expense Formula How To Calculate

What Rate Of Return Beats Whole Life Insurance The Insurance Pro Blog

Principal Paydown Think Realty A Real Estate Of Mind